The world of forex trading can be exciting yet overwhelming, especially for beginners who are just entering. To successfully navigate through the forex market, it’s essential to understand the common terms used in forex trading. Whether you’re trading currencies, speculating on economic events, or building long-term strategies, learning these terms will help you make informed and good decisions and improve your trading results.

In this article, we’ll explore the most common forex trading terms and what they mean in practice, giving you a solid foundation to begin or improve your trading journey.

1. Currency Pair

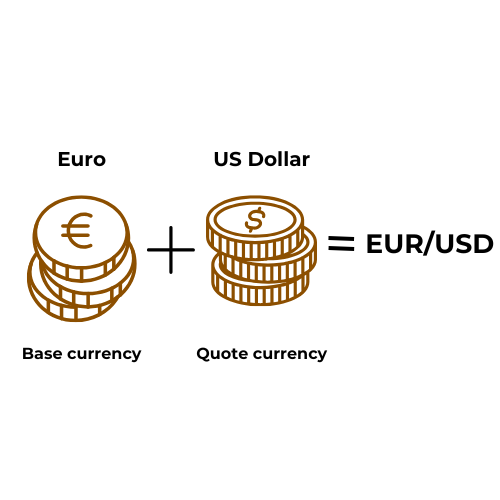

In forex trading, currencies are traded in pairs (traded together), known as currency pairs. The first currency in the pair is called the base currency, and the second is the quote currency.

When you buy a currency pair, you’re buying the base currency and selling the quote currency. For example, in the EUR/USD pair, the euro (EUR) is the base currency, and the U.S. dollar (USD) is the quote currency. So, you are buying EUR which is the base currency and selling USD which is quote currency.

Major Currency Pairs: These include pairs with the U.S. dollar, such as EUR/USD, GBP/USD, and USD/JPY.

Cross Currency Pairs: These are pairs that don’t include the U.S. dollar, like EUR/GBP or AUD/JPY.

Understanding currency pairs is important in forex trading since they represent the prices and relative values of different currencies.

2. Pip

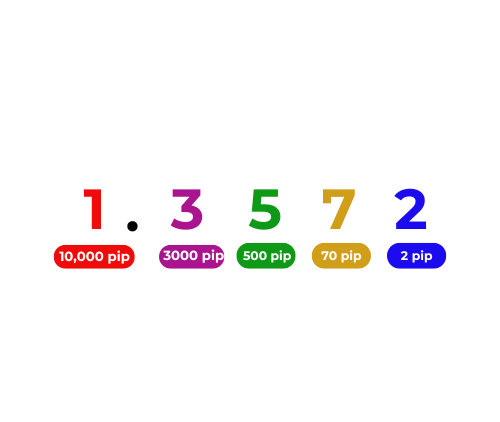

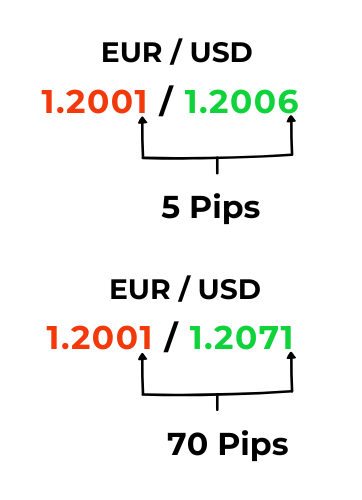

A pip (percentage in point) is a measurement of movement in forex trading, used to define the change in value between two currencies. It is the smallest standardized move that a currency quote can change by. Pips are used by traders to calculate the spread between the bid and ask prices of the currency pair, and express the profit or loss that their position has made.. For most currency pairs, a pip is equivalent to 0.0001 (fourth decimal place). However, for pairs involving the Japanese yen (JPY), a pip is typically the second decimal place (0.01).

For example, if the EUR/USD moves from 1.2000 to 1.2005, it has moved 5 pips. Pips are used to calculate gains or losses in forex trading, making them a crucial forex trading term to understand.

3. Spread

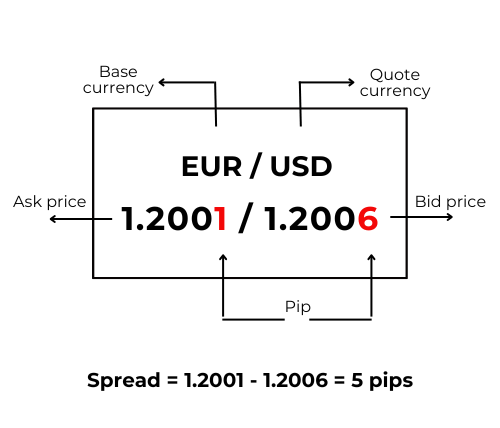

The spread is the difference between the bid price (the highest price a buyer is willing to pay for a currency pair) and the ask price (the lowest price a seller is willing to accept). Brokers make money from this difference, and a smaller spread is typically beneficial for traders, as it reduces transaction costs.

For example, if the Bid price of EUR/USD is 1.1064 and the Ask price is 1.1067, the Spread is 1.1064 – 1.1067 = 3 pips

There are two types of spread in trading;

1. Fixed Spread: This type of spread does not change no matter the market condition. It is used by brokers operating as market maker or a ‘dealing desk’ model.

Brokers operating the dealing desk model buys in large position from their liquidity provider(s) and offers the position in small quantity to their clients.

2. Variable Spread: This type of spread constantly changes. It is used by brokers operating a ‘non-dealing desk’ model. Non-dealing desk brokers get their currency pair prices from various liquidity providers and give these prices to the trader without going through a dealing desk.

This means these brokers have no control over the spreads. The spread can either be narrow or wide depending on the supply and demand of currencies and the overall market volatility

In highly liquid markets, such as major currency pairs, the spread tends to be narrow, while exotic or less traded currency pairs tend to have wider spreads.

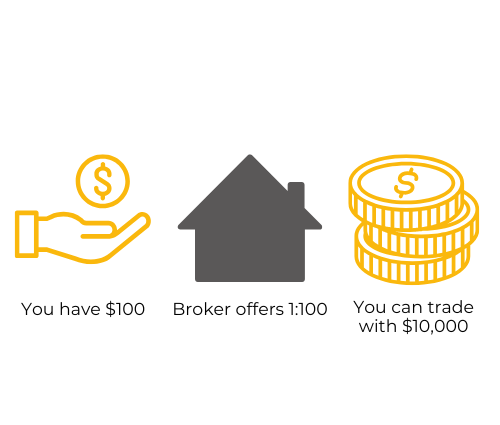

4. Leverage

Leverage is the use of borrowed money (called capital) to invest in a currency, stock, or security. The concept of leverage is very common in forex trading. By borrowing money from a broker, investors can trade large positions in a currency. As a result, leverage magnifies the returns from favorable movements in a currency’s exchange rate. For example, if a broker offers 100:1 leverage, you can control $10,000 in the market with just $100 of your own money. While leverage can magnify profits, it can also increase the risk of significant losses, especially in volatile markets.

In forex trading, it’s essential to manage leverage carefully to avoid margin calls or losing more than your initial investment.

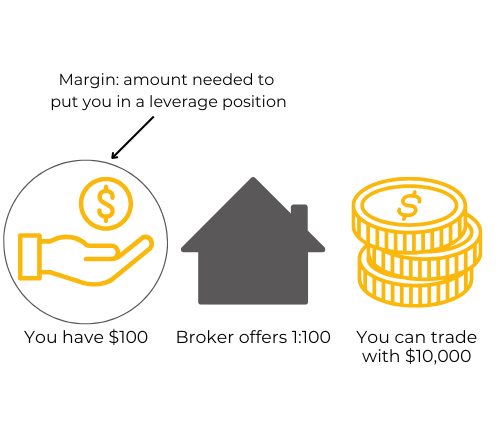

5. Margin

Margin is the amount of money required to open and maintain a leveraged position. It acts as collateral for the broker in case the market moves against the trader. In forex trading, initial margin is the amount needed to open a position, while maintenance margin is the amount needed to keep that position open.

If your account equity falls below the required maintenance margin, you may receive a margin call, which forces you to either deposit more funds or close some positions to free up margin.

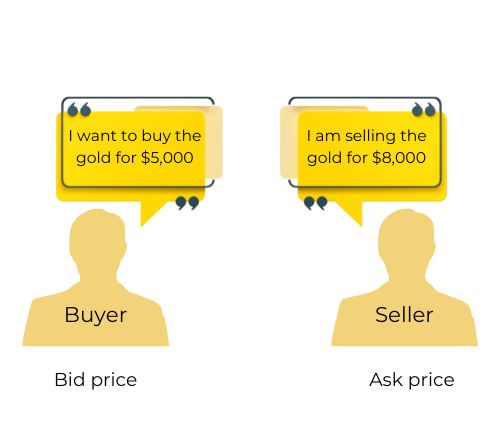

6. Bid and Ask Price

The bid price is the price at which a buyer is willing to purchase a currency pair, while the ask price is the price at which a seller is willing to sell it. As previously mentioned, the difference between these two prices is the spread. Traders buy at the ask price and sell at the bid price.

Understanding the bid and ask prices is crucial for making profitable trades, as the spread impacts the entry and exit points of your positions.

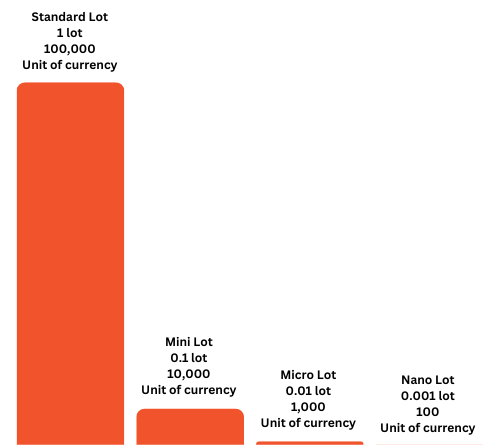

7. Lot Size

In forex trading, currencies are traded in standard units called lots. The size of a lot determines the amount of currency being traded.

Standard Lot: A standard lot is 100,000 units of the base currency.

Mini Lot: A mini lot is 10,000 units of the base currency.

Micro Lot: A micro lot is 1,000 units of the base currency.

Nano Lot: A nano lot is 100 units of the base currency

Traders can choose different lot sizes based on their account size, risk tolerance, and trading strategy. Trading smaller lots, such as micro or mini lots, is often recommended for beginners to limit risk.

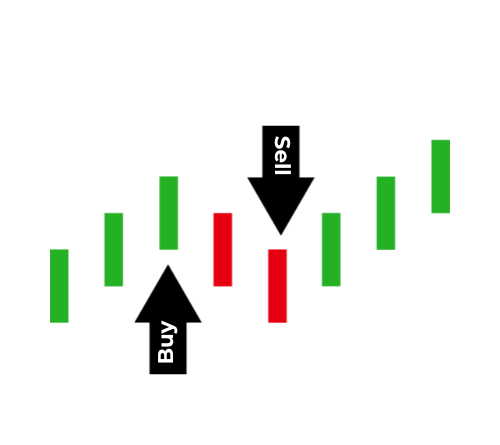

8. Long and Short Positions

Long Position: In forex trading, going long means buying a currency pair with the expectation that the price will rise. For example, if you go long on EUR/USD, you are buying euros and selling U.S. dollars, hoping that the value of the euro will increase relative to the dollar.

Short Position: Going short means selling a currency pair in anticipation that its price will fall. For instance, if you short USD/JPY, you are selling U.S. dollars and buying Japanese yen, expecting the value of the yen to rise relative to the dollar.

Understanding long and short positions is crucial for forex traders looking to profit from both rising and falling markets.

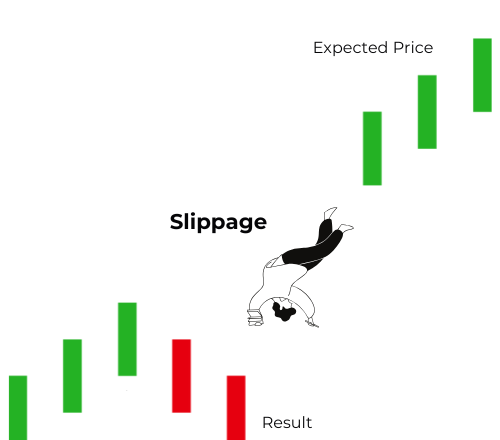

9. Slippage

Slippage occurs when an order is executed at a different price than the one you expected. This typically happens in fast-moving or highly volatile markets where prices can change rapidly before the order is filled.

For example, if you place a market order to buy EUR/USD at 1.2000, but due to volatility, your trade is executed at 1.2010, the 10-pip difference is considered slippage. Slippage can work for or against a trader, depending on market conditions.

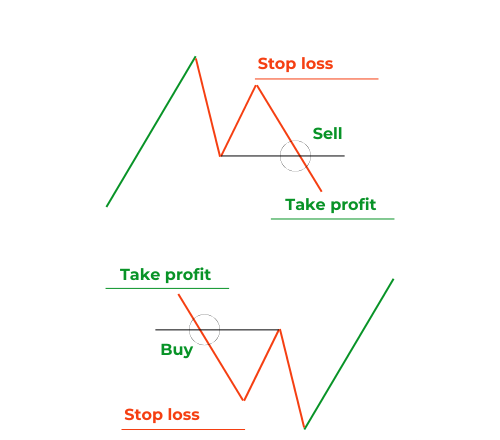

10. Stop Loss and Take Profit

Stop Loss: A stop-loss order is an instruction to close a trade when the market moves against your position by a certain amount. It helps limit potential losses. For example, if you buy EUR/USD at 1.2000 and set a stop loss at 1.1950, the trade will automatically close if the price drops to 1.1950, protecting you from further losses.

Take Profit: A take-profit order is an instruction to close a trade when the market moves in your favor by a certain amount, allowing you to lock in profits. If you buy EUR/USD at 1.2000 and set a take-profit order at 1.2100, the trade will automatically close when the price reaches 1.2100, securing your profit.

11. Technical Analysis

Technical analysis is the study of historical price movements and patterns to forecast future price movements. Traders use charts, indicators, and patterns to analyze trends and make informed trading decisions. Common technical analysis tools include moving averages, Relative Strength Index (RSI), and Fibonacci retracements.

Forex traders use technical analysis to identify entry and exit points, monitor price trends, and develop trading strategies.

12. Fundamental Analysis

Fundamental analysis focuses on evaluating the underlying factors that affect the value of a currency, such as economic data, interest rates, inflation, and geopolitical events. In forex trading, fundamental analysis is used to predict the long-term value of a currency based on the strength of a country’s economy and monetary policy.

For example, traders might analyze a country’s Gross Domestic Product (GDP), unemployment rates, and central bank decisions to gauge the strength of its currency.

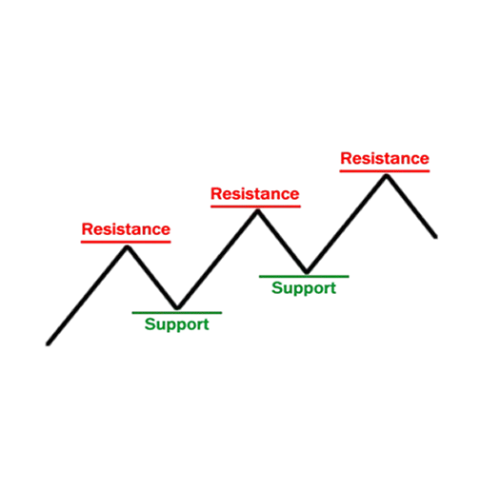

13. Support and Resistance

Support: A price level where demand for a currency pair is strong enough to prevent the price from falling further. It acts as a “floor” for the price.

Resistance: A price level where selling pressure is strong enough to prevent the price from rising further. It acts as a “ceiling” for the price.

Traders use support and resistance levels to make trading decisions, as prices often bounce off these levels or break through them, signaling potential market movements.

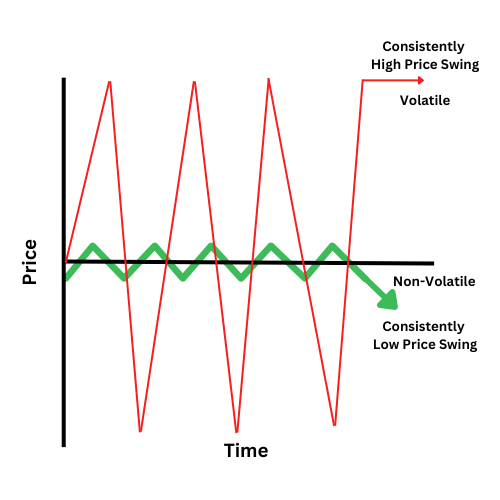

14. Volatility

Volatility refers to the degree of price fluctuations in a currency pair over time. High volatility means that prices move rapidly, creating more trading opportunities but also increasing risk. Low volatility indicates stable, predictable price movements.

Volatility is a critical forex trading term as it impacts the risk and reward of trading strategies.

15. Hedging

Hedging is a risk management strategy that involves buying or selling an investment to potentially help reduce the risk of losses of an existing position. For example, a trader might buy EUR/USD while simultaneously selling GBP/USD to reduce exposure to potential losses in one of the trades.

Hedging can help traders minimize risk in volatile markets, though it may also limit potential profits.

16. Broker

A forex broker serves as an intermediary between retail traders and the foreign exchange market, allowing individuals to buy and sell currencies. Brokers offer trading platforms, leverage, and various tools to help traders execute trades. When choosing a broker, consider factors such as regulation, fees, spreads, and customer support.

Conclusion

Learning the popular forex trading terms is essential for anyone entering the world of currency trading. From understanding pips and leverage to using technical and fundamental analysis, having a strong understanding of these terms will help you make better trading decisions and navigate the forex market with confidence.

With these basic terms, you’ll be better equipped to analyze markets, manage risks, and improve your overall trading performance. Remember that education is key in forex trading, so continue learning and refining

Watch Video to learn more on the various trading terms and how to apply them.