Forex trading strategies are essential for traders aiming to navigate the currency markets successfully. This article delves into the concept of forex trading strategies, highlights five prominent approaches, and offers guidance on selecting the strategy that aligns best with your trading style and objectives.

What Is a Forex Trading Strategy?

A forex trading strategy is a systematic plan that forex traders use to determine when to buy or sell a currency pair. It encompasses a set of rules and methodologies based on technical analysis, fundamental analysis, or a combination of both. The primary goal is to identify optimal entry and exit points to maximize profits while managing risks effectively. Strategies can vary significantly, catering to different time frames, risk tolerances, and market conditions.

5 Best Forex Trading Strategies

1. Trend Trading Strategy

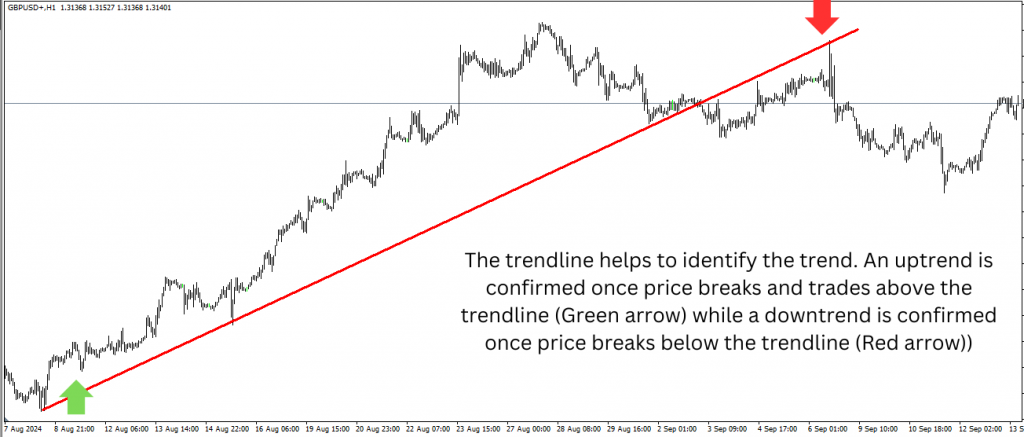

Trend trading or trend following is a trading strategy that involves identifying the direction of a prevailing trend in the financial markets and then buying or selling assets in accordance with that trend.

It involves identifying and following the prevailing direction of the market, whether upward (bullish) or downward (bearish). Traders utilize tools such as moving averages, trend lines, and momentum indicators to confirm trends and make informed decisions. They analyze price patterns and charts to determine areas of support and resistance.

Advantages:

1. Simplicity: By aligning trades with the market’s direction, traders can capitalize on sustained movements.

2. Clarity: Clear entry and exit points can be established using technical indicators.

Considerations:

1. False Signals: Markets can exhibit short-term fluctuations that may be mistaken for trends.

2. Patience Required: Trends can take time to develop, necessitating patience and discipline.

2. Range Trading Strategy

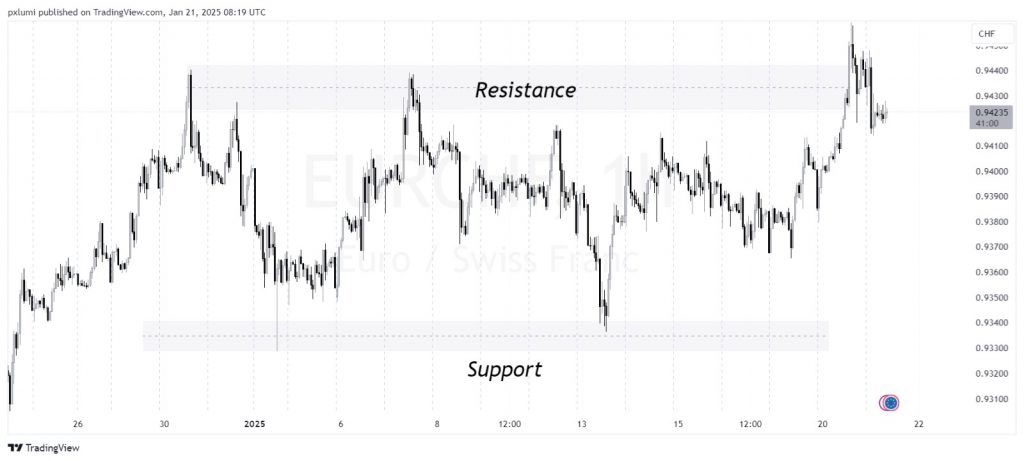

Range trading is the strategy of finding entry and exit points within consolidating markets, that is, a market that’s constantly trading between two known lines of support and resistance.

It capitalizes on markets that moves between defined support and resistance levels without a clear long-term trend. Traders buy near support and sell near resistance, profiting from predictable price movements within the range.

Advantages:

1. Frequent Opportunities: Range-bound markets offer multiple entry and exit points.

2. Predictability: Established levels of support and resistance provide clear trading signals.

Considerations:

1. Breakouts: Markets can break out of ranges unexpectedly, leading to potential losses.

2. Market Conditions: Range trading is less effective in trending markets.

3. News Trading Strategy

News trading is a strategy that seeks to take advantage of opportunities that arise in the markets when relevant economic data and information hit the headlines.

It focuses on capitalizing on market volatility following economic announcements, geopolitical events, or other significant news. Traders analyze the potential impact of news and position themselves accordingly.

Advantages:

1. Quick Profits: Significant news can lead to rapid price movements, offering swift profit opportunities.

2. Clear Catalysts: Scheduled news events provide predictable times for potential market moves.

Considerations:

1. High Volatility: News events can cause erratic price movements, increasing risk.

2. Slippage: Rapid market moves can lead to execution at unfavorable prices.

4. Scalping Strategy

Scalping is a trading strategy geared towards profiting from minor price changes in a stock’s price. Traders who implement this strategy place anywhere from 10 to a few hundred trades in a single day with the belief that small moves in stock prices are easier to catch than large ones.

It involves making numerous trades to profit from small price movements over short time frames. Scalpers often use technical analysis and real-time data to execute trades swiftly, aiming for small gains that accumulate over time.

Advantages:

1. High Frequency: Multiple trading opportunities arise within a single day.

2. Limited Exposure: Short holding periods reduce exposure to market risks.

Considerations:

1. Intensive Monitoring: Requires constant attention to market movements.

2. Transaction Costs: Frequent trading can lead to higher transaction costs, impacting profitability.

5. Carry Trade Strategy

This strategy entails borrowing in a currency with a low-interest rate and investing in a currency with a higher interest rate. The goal is to profit from the interest rate differential between the two currencies. However, carry trades can be risky if exchange rates move unfavorably.

Advantages:

1. Interest Income: Earn interest rate differentials in addition to potential capital gains.

2. Long-Term Potential: Suitable for traders with a longer-term outlook.

Considerations:

1. Exchange Rate Risk: Currency fluctuations can offset interest gains.

2. Leverage Risks: Carry trades often involve leverage, amplifying both gains and losses.

How to Find the Best Forex Trading Strategy That Works for You

Selecting the most suitable forex trading strategy requires careful consideration of several factors:

1. Risk Tolerance: Assess how much risk you are willing to take. Strategies like scalping involve higher frequency trades and may carry more risk, while trend trading might be more suitable for those preferring longer-term positions.

2. Time Commitment: Determine how much time you can dedicate to trading. Scalping requires constant monitoring of the markets, whereas strategies like carry trades or trend trading may be less time-intensive.

3. Market Knowledge: Evaluate your understanding of the forex market. Some strategies necessitate a deep knowledge of technical indicators and chart patterns, while others may rely more on fundamental analysis.

4. Testing and Adaptation: Before committing real capital, test your chosen strategy using demo accounts. This practice allows you to understand the strategy’s dynamics and make necessary adjustments without financial risk.

Remember, there is no one-size-fits-all strategy in forex trading. It is often beneficial to combine elements from multiple strategies to develop an approach that aligns with your trading goals and adapts to changing market conditions.

By understanding and applying these strategies thoughtfully, traders will be able to make more informed decisions and improve their chances of success in the forex market.

I like this teaching I have learnt how to buy what I e now is how to sell